WHY IS DENMARK WHERE IT’S AT IN HEARING?

Three of the big five hearing aid manufacturers have emerged from the same Scandinavian fountainhead: Denmark is the birthplace of Demant, GN, and WS Audiology. We asked all three to tell their stories and to try to explain why this Nordic former superpower developed such prominence in the worldwide hearing industry.

Look at a list of countries by electronics exports (International Trade Centre) and you don’t see Denmark in the top 30 (which even includes Romania, Hungary, and Indonesia). When it comes to electric generating sets and rotary converters, however, Denmark is placed fourth, behind China, Germany, and the United States.

But such statistics can be highly deceptive. In the details, there is a story. Observatory of Economic Complexity (OEC) figures (2022) for hearing aid exports show that out of a total of US$6.45bn in exports, Denmark sits on 7.95%, well behind Poland’s 21.6%. The US is on 8.44%, Singapore 8.27%, and Mexico 6.12%.

WS Audiology

WS Audiology’s Global Headquarter is based in Lynge, Denmark. The characteristic circular building has been energy neutral since it was completed in 2010. The building has a geothermal system that uses groundwater as a reservoir for heating and cooling. Together with an associated wind turbine and solar park, this means 100% green energy consumption at the site.

We are not concerned particularly with examining China or Vietnam’s close-to 10% of this pie, but to show just how involved this picture is, look closer: we see that Denmark’s Demant has been continuously building its position in Poland since the 1990s and currently employs over 3700 high-class engineers and specialists in its Polish operations. In Mexico, Switzerland’s Sonova has recently accounted for maximum export market share, followed by Starkey, though Denmark’s WS Audiology has had its Americas Manufacturing and Distribution Centre (AMDC) in Tijuana, Mexico since 2022, and the hearing aid manufacturer makes product there for Signia, Rexton, TruHearing, and hear.com.

In fact, WSA has five main production sites in addition to its Denmark base: Singapore, China, Mexico, Poland, and the Philippines. The truth is complex, but dig around and you see that, outside of the Swiss manufacturer Sonova, and the USA’s Starkey, so much of hearing product comes back to where it comes from…in Denmark.

Denmark – a coincidence? Or the stuff of business clusters?

“Denmark is called the Silicon Valley of sound,” the WSA team explains. “The reason that three of the largest hearing aid companies are based in Denmark – and less than 25 kilometres from each other – is somewhat by coincidence, and somewhat what we see in more business clusters.”

“Large companies in a specific cluster attract specialised employees who sometimes start a spin off,” WSA propose. “With Denmark being a quite small country, manufacturers had to market their products internationally at an early stage. The very first batch of Widex products was sold in the UK, for example.”

“This may have helped the Danish manufacturers to grow to a size that allowed them to thrive throughout the first wave of consolidation in the ‘80s and early ‘90s,” add the WSA experts. “Size and strong engineering talent then helped the Danish industry through the second wave in the early ‘00s, where the remaining analogue players were acquired or closed. At that point, having critical mass in digital R&D was essential to compete.”

Danish engineering strength

WS Audiology

Christian Tøpholm and Erik Westermann founded Widex in 1956.

Concurring with WSA’s emphasis on the workshop ingenuity available in Denmark, GN spokespersons explain it thus: “Denmark has a long-standing tradition of excellence in engineering and technology, fostered by a strong emphasis on research and development. Danish companies were early adopters of digital technologies and have focused on understanding the needs of hearing aid users, leading to innovations that improved user experience.”

“In the 1990s, hearing aid manufacturers in Denmark introduced some of the first fully digital hearing aids. These devices offered significant improvements in sound processing, customisation, and user comfort, solidifying Denmark’s reputation as a leader in hearing technology.”

Queen Alexandra (1844-1925) in regal dress and crown for the coronation of her husband King Edward VII.

An academic connection that binds engineering prowess to health

Demant expands the picture. Karen Wibling Solgård, Market Manager, Oticon Nordics, explains: “The Danish hearing industry is built on a solid foundation of the industry and the university hospital, working together for years. The collaboration has meant that the parties both challenged each other and learned from each other. This cooperation between universities and industry has been an important factor and led to a strong focus on sound and of the digitalisation of sound.”

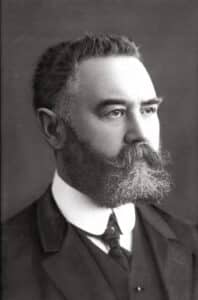

Demant

Hans Jørgen Demant imported the type of hearing aid used by Queen Alexandra of England.

This view is amplified by Demant’s Thomas Behrens, Vice President, Audiology and Applied Research, who affirms: “In the early 1950s, some pioneers within the academic/medical field supported the authorities in creating a tender for hearing aids, which was asking for better technology. Basically, something that did not exist at that time. That then kickstarted innovation within the field and continued with the three Danish companies. On top of this there is a common interest from the companies to highlight, with candidates needed from the academic institutions. Danish Technical University (DTU) and Odense University are now conducting key research within the area.”

The strength of Denmark’s university base is further underlined by WSA: “Denmark has one of the top Technical Universities in Europe, DTU. Furthermore, throughout the later part of the 20th century, the Danish hearing aid industry had cooperation with all Danish universities, and this clearly benefited both sides. Several universities had Audio and Audiology classes quite early on, giving rise to talents in these fields.”

And GN firmly agrees, stressing the widely respected sturdiness of Danish epidemiological studies:

GN

GN HQ Ballerup Copenhagen, Denmark

“Danish academic institutions often encourage interdisciplinary collaboration, bringing together expertise from epidemiology, audiology, engineering and technology. Denmark has been a leader in epidemiological studies related to hearing loss and public health. Large-scale studies and longitudinal data have provided valuable insights into the prevalence, causes and impact of hearing loss, informing the development of leading hearing aids. Danish research has highlighted the importance of hearing health as a public health issue. Findings from epidemiological studies have helped shape public health policies and awareness campaigns, increasing the demand for advanced hearing solutions.”

And the Danish manufacturers have keenly collaborated in such research:

“There is a lot of collaboration between academia and industry in Denmark. Hearing aid manufacturers have established partnerships with universities and research institutes to leverage academic research for product development. Denmark has developed innovation hubs and research clusters that facilitate collaboration between scientists, engineers, and industry professionals. These hubs have been instrumental in translating academic research into practical and innovative hearing aid technologies.”

Government fostering tech and healthcare in Denmark

A country can have talent, and its institutions can be advanced pools for resources that developing enterprises can exploit to their advantage, but what is it about Denmark’s particular business climate and structure that has enabled the country’s producers to gain such a foothold?

GN points to Denmark having “a highly collaborative business culture, fostering partnerships between companies, research institutions and the government.”

GN Store Nord C.F.Tietgen 1872 Founder of The Great Northern Telegraph Company.

Such providence for innovation and the development and commercialisation of new technologies is behind, for example, GN’s partnering with Sonde Health, a leading vocal biomarker company, to research and develop commercial vocal biomarkers for mild cognitive impairment. “Through this partnership, we will be the first to scale voice-based cognitive biomarkers to a large population to give people insight into their mental fitness and provide a better and earlier understanding of mild cognitive impairment,” the Group reveals.

“Danish companies have strategically built extensive global distribution networks. By establishing partnerships with local distributors and service providers around the world, they have ensured wide accessibility and support for their products. GN’s hearing aids are sold in around 100 countries across the world. We have our own customer teams in over 30 countries and operate via partners and distributors in another 70 countries.”

Oticon’s Karen Wibling Solgård also points to the easy and fruitful collaborations that Demant has enjoyed in its native land: “Hans Demant was an early adopter of importing hearing aids to Denmark, and the Demant family continued the focus after him, creating a solid basis and expertise whilst the demand for hearing aids was rising globally. Denmark has a long tradition of working with sound and medtech. Through the years, Denmark has been the home of big audio-focused companies like Bang & Olufsen, Bruel & Kjær, Demant, GN, and several more.”

Demant

Oticon’s Eriksholm Research Centre, Snekkersten, Denmark.

For WS Audiology, home is where health is, and Denmark has provided a highly comfortable framework for developing business.

“One of the main reasons for the health tech and bio science success of Denmark is the long-term ownership perspective, often driven by family ownerships that over time turn into enterprise foundations that secure survival, growth and development through volatile markets and other sequential business challenges,” said the WSA team.

“The long-term perspective leaves room for scientific discoveries, innovation and development in R&D intensive industries. The model has been instrumental for the success of Denmark’s largest life science companies as well as a seed forest of young biotech companies, which are making progress despite difficult markets. All this has made life science one of the leading export industries in Denmark and has shown investors that the Danish MedTech and biotech scene is not a fairy tale but a real and growing market for investors and collaborators,” adds WSA, stressing that the enterprise foundation model is not the only reason behind the success of Danish healthcare.

WS Audiology

NOW: The Widex SmartRIC hearing aid features a groundbreaking L-shaped design that places the microphones at an improved angle to enhance directionality and better align with the wearer’s focus.

“The government supports innovation and entrepreneurship, and progress is driven by the country’s scientific strengths, which enable discoveries that pave the way for new products and treatments. Denmark’s big enterprise foundations are important financial supporters of its eight universities through a wide range of philanthropic grants, in particular, though not exclusively, for bio- and healthtech.”

And help from above is also gratefully acknowledged by GN: “The Danish government has also provided consistent support for the technology and healthcare sectors through favorable policies, grants, and incentives.”

Profession and industry working together

Perhaps one of the key dynamics of success that sets Denmark apart from other territories is the close working bond between its hearing care profession and the industry. GN has no doubts: “The hearing care profession in Denmark has mirrored the strength of its hearing aid industry, and there is a strong bond between the two. This close relationship has been mutually beneficial, fostering advancements in both fields.”

This close collaboration, says GN, focuses on understanding hearing loss, developing new technologies, and improving clinical practices. “GN works closely with audiologists, hearing care specialists, and researchers to develop and refine their products. The ongoing feedback loop provides valuable insights and feedback on the performance of hearing aids in real-world settings, which informs further product development and innovation.”

Maria Tuxen Hedegaard

Research by Oticon is fundamental to all hearing aid manufacturers. The Danish producers point to the benefits of good relationships with the country’s academia.

At Demant, External Communication Manager Henrik Axel Lynge Buchter highlights the mechanics of this relationship: “In Denmark you can study a Bachelor and a Master within Audiology, and the candidates can afterwards work within hospitals and private clinics. The service at both hospitals and private clinics is usually high and consisting of highly specialised employees. This ensures that the end user gets the most out of their hearing aids, and at Demant we are true believers that the meeting between the Hearing Care Professional and the end-user will heighten the listening-experience for the user. That focus is core for us in Denmark with the highly skilled personnel there, and it is a global focus to ensure that our users across the world receive specialised care when buying a hearing aid.”

And WS Audiology goes deeper into the social reverberations of the profession-industry axis: “Most people get hearing aids through a government owned buying group. Of course, we are closely connected with our customers, the hearing care professionals and retailers fitting people with Signia or Widex hearing aids. Denmark does have the highest penetration rate for hearing aids of any market, likely due to subsidies and maybe the local industry spreading cultural acceptance of hearing care.”

The EU – for some a “minor role”, for others “hugely beneficial”

Has being part of the European Union helped Denmark foster world leadership in health tech?

For WSA, “the EU played a minor role”, but GN takes another view.”Being part of the European Union (EU) has been hugely beneficial for Denmark’s hearing and health technology. As part of the EU, Denmark benefits from access to the single market, which allows for the free movement of goods, services, capital, and people. This access enables Denmark to easily export their products and services across the EU, significantly expanding market reach,” says the makers of the Nexia hearing aid.

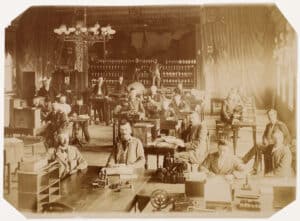

GN

Origins in telecommunications.

“Danish researchers and companies have access to EU research funding programmes like Horizon 2020 and Horizon Europe. These programmes provide substantial funding for collaborative research and innovation projects, enabling advancements in hearing and health technologies. Participation in EU-funded collaborative projects allows Danish institutions and companies to partner with leading research entities and businesses across Europe. This fosters innovation through shared expertise, resources, and knowledge,” continues GN.

And there is more: “As part of the EU, Denmark also benefits from trade agreements negotiated by the EU with countries around the world. These agreements facilitate the export of Danish health and hearing technologies to global markets, enhancing their international presence.”

Demant

Bronwen Coleman, General Manager, United Kingdom & Ireland, Demant.

1904 Founded by Hans Demant.

On August 9, 1902, the Danish-born Crown Princess Alexandra, daughter of the Danish King Christian IX, wore a hearing aid for her coronation as Queen of England. And this led Hans Demant to start a business by importing that same type of hearing aid. He was soon to win a contract with the American manufacturer General Acoustic Company, selling his first hearing aid in Odense, Denmark.

In 2024, Demant celebrates its 120th anniversary. Read more on the Demant story here: https://www.demant.com/about/our-history

Demant is now fully focused on garnering revenue from its business areas in Hearing Aids (brands are Oticon, Bernafon, Sonic, and Philips), Hearing Care (retail) – Audika Group is made up of several strong local brands, such as Audika, HearingLife, Hidden Hearing and Acústica Médica – and Diagnostics (Maico, Interacoustics, Amplivox, Grason-Stadler). The group is currently conducting a strategic review on its Communications Business Area, and has completed a sale of its Cochlear Implants division.

30 Demant has offices in 30 countries

130 Demant has distribution in 130 countries, and is listed on the Nasdaq in Copenhagen among the 25 most traded stocks.

DKK 22,443m (approx. 3bn euros) sales in 2023 (up from 9,000m DKK in 2014, and 4,000m in 2004).

21,600 full time employees (up from 10,000 in 2014, and 5,000 in 2004)

WSA

Philip Stores Managing Director WS Audiology

WSA is a €2.5 billion, pure play hearing aid company, headquartered in Lynge, Denmark.

WSA’s main product brands are Signia, Widex and Rexton.

12,500 – the number of WS Audiology employees worldwide.

1956 – The year Widex was founded by electronics engineeer Christian Tøpholm, and Erik Westermann, a successful sales manager. Both worked for Oticon, but decided to build their own hearing aid company.

The cellar beneath Christian Tøpholm’s suburban home in Naerum, Denmark, was taken into use as a combined development laboratory, workshop and production hall.

Widex 561 – the first hearing aid launched in 1956 by Widex, an elegant pocket model (or body-worn) device.

1996 – Widex was the first company to sell a digital signal processing (DSP) hearing aid, the Senso.

2010 – The Widex committment to corporate social responsibility and ethical standards – and its passion for advanced engineering and social responsibility – sees the construction of their completely CO2 neutral headquarters in Lynge, Denmark.

2019 – the year Widex merged with Sivantos, the former Siemens hearing aid company, to create a new company called WS Audiology.

GN

Paul-Daft-General-Manager-GN-Resound

GN was founded more than 150 years ago in the field of telecommunications.

1869 Founder C.F. Tietgen envisioned a more connected world, creating the first telegraphic connection between China and the rest of the world.

Today, GN boasts the broadest portfolio of products and services in its history: hearing aids, speakerphones, videobars and headsets. GN Store Nord A/S is listed on NASDAQ OMX Copenhagen.

The group claims several firsts in hearing tech:

2010: 2.4 GHz technology in hearing aids for direct connectivity.

2014: Made-for-iPhone hearing aids with direct stereo sound streaming.

2020: Hearing aid with a microphone and receiver in the ear (ReSound ONE and M&RIE).

2021: First all-in-one earbuds with advanced hearing technology (Jabra Enhance Plus).

2023: The first hearing aids to support Bluetooth LE Audio including Auracast broadcast audio (ReSound Nexia).

DKK 1.7bn (approx €228m) – GN’s R&D spend in 2023

How long can Denmark’s hearing triumvirate maintain a leading global presence?

So, will the prominence of the Danish manufacturers hold until, say, 2035?

“It is highly possible that that will be the case,” says Oticon’s Karen Wibling Solgård.”The long tradition of public/private partnerships will continue and that can maybe even strengthen our position. Innovation is of course important in order to live up to being dominant, but with a strong Danish foundation within hearing healthcare, I believe we will still see strong Danish players in the market until then.”

GN’s view hardly varies: “Anticipating and adapting to market trends and consumer needs have historically contributed to Danish manufacturers success and we see this continuing to provide a strong foundation for future growth.”

The confidence of GN rests on the continuance of several pillars:

• Continued innovation and R&D investment, including investment in artificial intelligence, machine learning, and advanced signal processing;

• Strong industry-academia collaboration to facilitate the rapid translation of research into practical applications, a synergy that”ensures that Danish manufacturers have access to the latest scientific discoveries and can integrate these advancements into their products quickly“.

• High-quality standards and reputation, which has built a loyal customer base and high brand trust.

• Emphasis on user experience and customer satisfaction, with innovations such as intuitive fitting software and user-friendly interfaces enhancing the overall experience for both users and hearing care professionals.

• Integration of digital health and teleaudiology, a growing trend GN believes Danish manufacturers “are at the forefront of developing and implementing”.

And while WSA – despite its heavy investment in strong engineering, sourcing, production and marketing capabilities for Signia in Singapore – continues to develop as a leading global company”with only one HQ, located in Lynge, Denmark“, it too envisages long-term Danish distinction:”The ambition is there, supported by the fact that we have this long-term ownership perspective, a strong industry association (Danish Industry), a highly qualified technical and financial work force that is attracted from all over the world and a very high quality of life in Denmark.“

Though “grateful” to have Singapore as its central hub to serve the Asia Pacific region, WSA has a “strong R&D team” in Erlangen, Germany, where all Signia, Rexton, Sony, Audio Service and Vibe hearing aids are invented and engineered. “And we recently opened a software R&D center in Hyderabad, India,” says the group with the last word that its compatriots – and rivals – might be expected to echo happily:

“We are Danish and global!”